Enhance Your Building: Competence in Trust Foundations

Wiki Article

Strengthen Your Legacy With Specialist Trust Structure Solutions

In the realm of tradition preparation, the relevance of establishing a solid foundation can not be overstated. Professional count on foundation solutions supply a durable structure that can protect your properties and ensure your desires are performed precisely as planned. From decreasing tax obligation liabilities to choosing a trustee that can capably handle your events, there are important considerations that demand interest. The complexities included in trust structures require a calculated strategy that straightens with your long-lasting objectives and worths (trust foundations). As we explore the subtleties of trust fund foundation services, we discover the vital components that can strengthen your tradition and give an enduring influence for generations to come.Advantages of Trust Fund Foundation Solutions

Count on structure remedies offer a durable structure for safeguarding assets and guaranteeing lasting financial protection for people and organizations alike. One of the main benefits of count on foundation options is possession protection. By establishing a trust fund, people can secure their properties from potential threats such as legal actions, creditors, or unexpected economic responsibilities. This defense ensures that the properties held within the trust remain safe and secure and can be handed down to future generations according to the individual's dreams.In addition, trust fund foundation solutions supply a strategic strategy to estate planning. With depends on, people can outline just how their possessions should be taken care of and distributed upon their passing away. This not only aids to stay clear of problems among recipients however likewise makes certain that the person's legacy is maintained and handled properly. Depends on likewise use personal privacy advantages, as properties held within a depend on are not subject to probate, which is a public and commonly prolonged lawful process.

Sorts Of Trust Funds for Legacy Preparation

When considering tradition planning, an essential aspect includes exploring numerous types of lawful instruments created to maintain and disperse possessions efficiently. One common kind of depend on made use of in legacy planning is a revocable living trust. This depend on allows people to maintain control over their possessions during their lifetime while guaranteeing a smooth transition of these possessions to beneficiaries upon their passing, avoiding the probate procedure and offering personal privacy to the family members.One more type is an irrevocable trust fund, which can not be modified or withdrawed as soon as established. This count on provides prospective tax advantages and shields properties from creditors. Charitable trusts are additionally prominent for individuals seeking to support a cause while maintaining a stream of income on their own or their beneficiaries. Special requirements trusts are vital for individuals with specials needs to ensure they get needed care and support without threatening federal government benefits.

Comprehending the different sorts of trusts available for heritage preparation is important in developing an extensive technique that aligns with specific objectives and priorities.

Selecting the Right Trustee

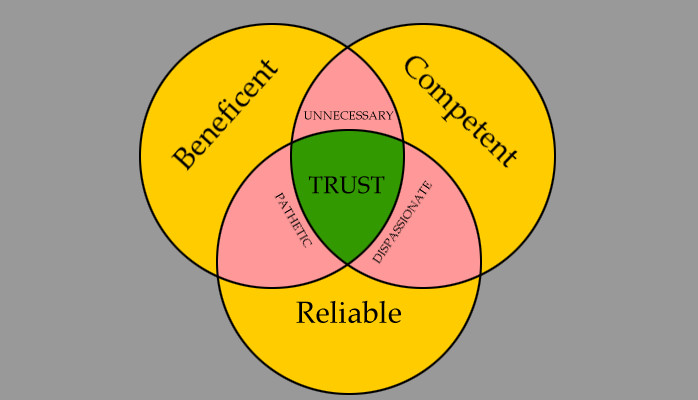

In the realm of legacy preparation, a crucial facet that requires visit mindful consideration is the selection of a suitable person to meet the essential role of trustee. Selecting the appropriate trustee is a choice that can significantly affect the effective implementation of a trust fund and the satisfaction of the grantor's desires. When picking a trustee, it is important to focus on qualities such as trustworthiness, economic acumen, stability, and a commitment to acting in the very best passions of the recipients.Ideally, the chosen trustee needs to have a strong understanding of economic matters, can making sound investment choices, and have the ability to navigate intricate legal and tax requirements. Moreover, effective communication skills, interest to information, and a desire to act impartially are site here additionally important characteristics for a trustee to have. It is suggested to choose someone who is dependable, accountable, and capable of meeting the duties and commitments connected with the function of trustee. By meticulously considering these aspects and choosing a trustee who lines up with the values and purposes of the trust fund, you can help make sure the lasting success and conservation of your legacy.

Tax Obligation Implications and Benefits

Considering the financial landscape bordering trust frameworks and estate planning, it is paramount to dig into the elaborate world of tax obligation ramifications and advantages - trust foundations. When establishing a trust fund, understanding the tax obligation effects is critical for optimizing the benefits and reducing prospective responsibilities. Trust funds offer numerous tax obligation advantages depending upon their framework and function, such as lowering inheritance tax, earnings tax obligations, and gift taxes

One view publisher site considerable advantage of particular depend on structures is the ability to move assets to beneficiaries with minimized tax consequences. Irreversible depends on can eliminate possessions from the grantor's estate, possibly decreasing estate tax obligation. Additionally, some trusts permit for revenue to be dispersed to beneficiaries, that may be in lower tax obligation braces, causing total tax financial savings for the family.

However, it is crucial to keep in mind that tax legislations are intricate and subject to transform, highlighting the necessity of consulting with tax obligation professionals and estate planning professionals to make certain conformity and make the most of the tax advantages of count on structures. Appropriately browsing the tax effects of trusts can cause significant cost savings and a more reliable transfer of wide range to future generations.

Actions to Developing a Count On

The initial action in developing a count on is to plainly define the objective of the trust and the assets that will certainly be included. Next off, it is important to choose the type of trust fund that finest aligns with your objectives, whether it be a revocable depend on, irreversible trust, or living count on.

Final Thought

In verdict, developing a trust structure can supply many benefits for legacy planning, consisting of property security, control over circulation, and tax benefits. By picking the appropriate type of trust and trustee, people can safeguard their possessions and ensure their dreams are executed according to their wishes. Recognizing the tax obligation effects and taking the essential steps to establish a depend on can aid reinforce your heritage for future generations.Report this wiki page